Formation

Minimize risk, maximize potential. Launch confidently with our support by your side.

Just released: How to raise venture capital in 2023

DownloadAfter enduring a hard-hit 2021, commercial insurance buyers enjoyed the reprieve of flattening...

In 2022, businesses began to bounce back from the challenges of the COVID-19...

It’s not uncommon for other professionals—vendors, cities, partners, investors, etc.—to require specific insurance...

Protects your company against damages from specific electronic activities

Protects your company against specific money theft crimes

Protects corporate directors and officers’ personal assets if they are sued

Provides healthcare, vision & dental, retirement plans, and life insurance

Protects companies against employment-related lawsuits

Protects companies against lawsuits of inferior work or service

Protects from legal liability relating to employee benefit plan sponsorship

Protects companies against basic business risks.

Reimburses companies for direct property losses

Covers employees if they are injured on the job and can no longer work

Covers damages sustained when employees use personal vehicles for business purposes.

Covers legal fees for companies facing infringement claims

Protects businesses and investors if an essential member of your team passes away.

Protects against legal liabilities arising from drivers making deliveries

A suite of policies to protect a company and its directors and officers

Protects against claims alleging your product or service caused injury or damage

Protects against the ever-growing risk of post-acquisition litigation

Protects against property loss or damage when it’s in transit or stored offsite

Extends other insurance policies to offer excess coverage where your business needs it

Covers lawsuits alleging management or investment advisory service failures

Protects individuals who create and publish content online.

Offers comprehensive coverage, designed to secure your digital investments against theft, hacking, and other cyber threats.

After enduring a hard-hit 2021, commercial insurance buyers enjoyed the reprieve of flattening D&O pricing in 2022 and...

In 2022, businesses began to bounce back from the challenges of the COVID-19 pandemic. Many companies hit their...

It’s not uncommon for other professionals—vendors, cities, partners, investors, etc.—to require specific insurance policies as a part of...

Ambitious companies need a partner to shield them from potential risks, roadblocks, & uncertainty. We’re the insurance broker that proactively covers your risk to keep the wind at your back.

Founder Shield is the innovation arm of the Baldwin Group, one the fastest-growing brokers in the country. For over a decade, we’ve supported ambitious startups from seed through IPO with our full suite of insurance and risk advisory services. Our mission is to create the most seamless, intuitive, and responsive experience to protect your company’s growth.

We cater to the specific needs of high-growth companies across various industries. From tech startups and innovative financial services firms to groundbreaking life sciences companies our practice advisors offer tailored risk management solutions for businesses built from the ground up.

Our focus is on venture-backed businesses, and our scalable services are designed to grow alongside your company, providing the protection you need at every stage.

Navigate the future, together. As tech leaders, we understand the challenges and opportunities. Our Specialists become an extension of your team, guiding you to success.

From groundbreaking research to commercialization, we understand your risks. Our Specialists navigate the ever-evolving regulatory landscape, empowering innovation while mitigating risk.

We combine user-friendly tech tools with comprehensive risk mitigation strategies. Experience peace of mind with a streamlined approach to financial protection.

We understand your established needs. Our Specialists leverage innovative solutions to enhance your existing operations ensuring stability and growth in the digital age.

Whether you’re developing your MVP or signing a term sheet, we understand that you’re on a tight budget, and need to be thoughtful about how you spend your capital. Connect with Startup Advisor to build your custom insurance program tailored to your stage.

Minimize risk, maximize potential. Launch confidently with our support by your side.

Fuel your funding round, not your fear. Get the insurance your investors will love.

Scaling up? Secure your climb: Our tailored insurance protects your growth and keeps you focused on conquering new heights.

Protect your legacy, secure your future: Custom-fit insurance plans for established companies that value long-term success.

From private to public, we've got you covered: Insurance designed for companies taking the leap onto the public stage.

Focus on the deal, not the what-ifs: Let our tailored insurance plans protect your exit strategy and give you peace of mind.

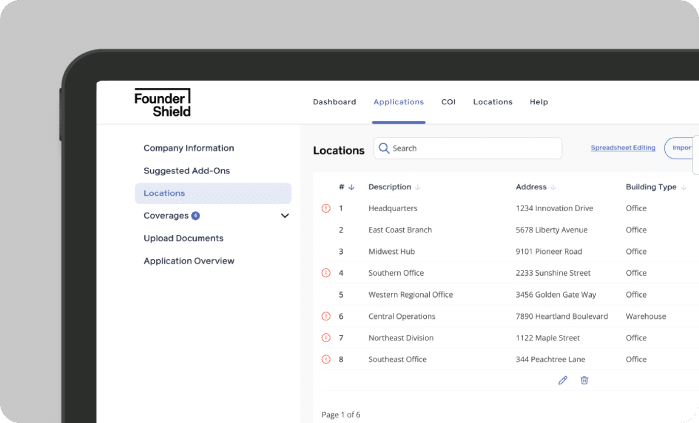

We utilize our technology platform to streamline the application & renewal process and automate all back-end document generation and carrier API connectivity to balance the customer experience with maximum quoting reach.

Receive dedicated assistance from a Founder Shield Risk Management Advisor who will offer ongoing advice and support, helping you select insurance options perfectly tailored to your business needs.

In-house claims advocacy team of lawyers to ensure optimal outcomes when your insurance package is needed most: claims situations.

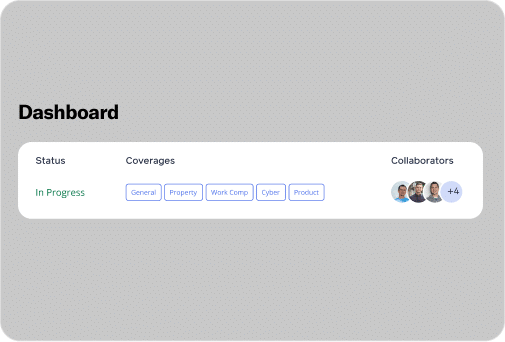

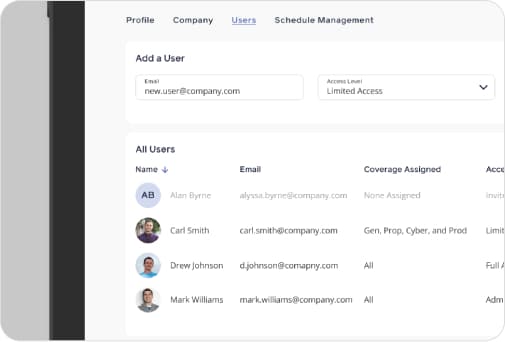

Our platform is designed to scale with you. Invite your finance, collaborate on the application in real-time with your vendors, and see how your program compares with your peers.

Our mission is to create the most seamless, intuitive, and responsive experience to protect your company’s growth.

We offer the full suite of insurance products necessary to protect management, investors, and high-growth companies.

Don’t go at risk management alone. We’re genuine and upfront about what coverage you need, laying out the best options after learning about your business.

We take a hands-on approach with our underwriter relationships, training them to understand your company’s culture, values, and organizational approach. Our suite of tools and emerging industry experience gives us the unique ability to set you up for the present and create a clear game plan for the future.

Our team of experts provides continuous guidance and support to ensure you purchase coverage that makes sense for your business. Reach out any time, day or night, for any reason (or no reason at all).

Founder Shield has been a great partner for us. My instructions are always pretty simple: tell us what we need, and tell us exactly how much it’s going to cost us. Founder Shield knows the drill and delivers what we need I try to be respectful of people’s time but if I have questions, they know I’m going to call. And they’re always available to provide answers.

I knew they operated differently than most brokers, and that their culture would be a better fit with ours. The application process moves so much more quickly because it’s automated. Since getting insurance is less tedious, I also have the time to take a broader look at our coverage, and work with the team to determine where there might be gaps that leave us exposed to unnecessary risk.