Key Takeaways

This post originally appeared on TechCrunch, you can read the article here.

How do you turn a cost center into a revenue engine? It’s a problem that, when solved, can supercharge a venture-backed company’s margins and truly accelerate growth.

Buying insurance is often a drag for company founders because they tend to look at it as nothing more than a time suck and a cost center. A simple “check the box” exercise.

Most of the time, founders don’t even think about insurance until they hit the first critical moments in a company’s lifecycle:

- Landing a B2B customer (they’ll always require General Liability , Errors and Omissions , and more…)

- Signing an office lease (General Liability & Property at a minimum)

- Scaling the team ( Workers Compensation , Employment Practices Liability Insurance and all the nit-picky legally required coverages)

The stimulus and response in these situations is obvious: check the box, sign the client/lease/employee, move on. Insurance is just a formality. It’s admin.

But there’s much more to it than that. If done correctly, insurance can not only be a strong shield to protect your growing operations, it can also be a sword to bolster funding efforts and increase revenue.

Insurance Strategy and the J-Curve

To understand how to transform insurance from a cost center to a funding and revenue generating tool we’ll use the J-Curve, the typical path of a venture-backed company, as our lens. Each phase of the J-Curve requires companies to place certain insurance policies and provides opportunities to create value through the company’s insurance program.

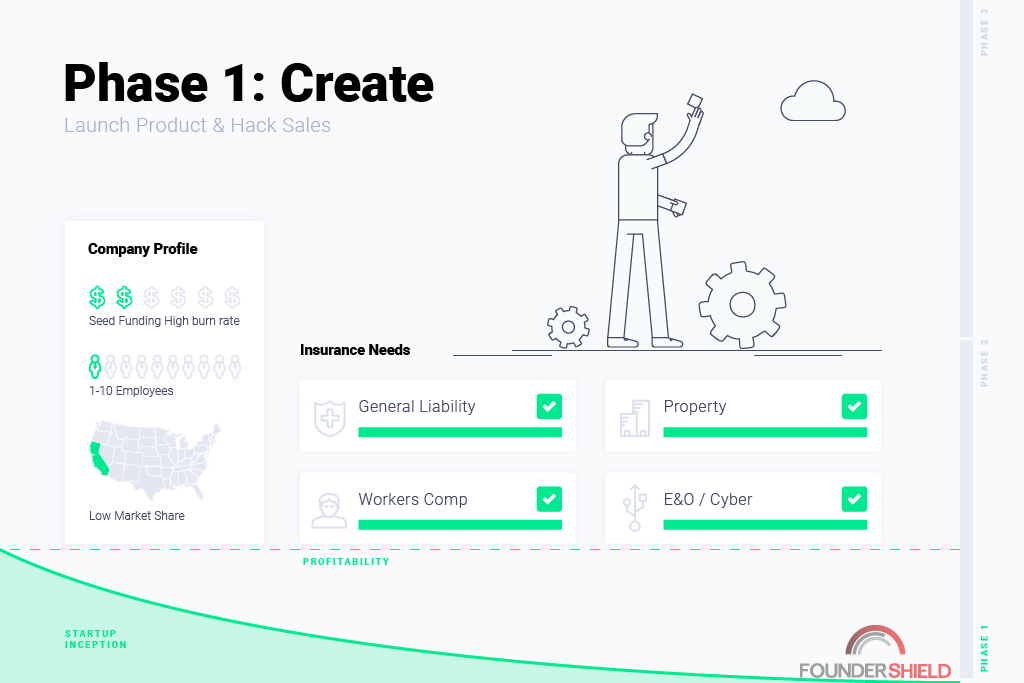

This section is short and sweet because this is the area of the curve where the “check the box” mentality will take over. In this stage the company is:

- Raising a friends & family or seed round

- Hacking sales with cold outreach, networking events, & signup landing pages

- Hiring the first 10 or so employees

- Iterating quickly to find a product market fit

This is the phase where the company will need all the basics discussed above. General liability, property, workers compensation, errors & omissions, & cyber liability can be crucial in this phase.

Phase 1 is all about creating the baseline insurance shield that will protect the company as it grows and scales. Though budgets are often tight during this phase, it’s important to get these policies in place as early as possible. If you buy insurance three years into the company’s life, the first three years of activity will often not be covered by the policies. They’ll have a “retroactive date” limiting coverage to after the inception of the policy, leaving you exposed to latent issues from the early years of pivots and rapid iteration. Nightmares of old can come back to haunt you.

In short: Companies in Phase 1 should set up insurance to ensure that they can land the first contracts, employees, and office space, and avoid skeletons in the closet from destroying progress in later years.

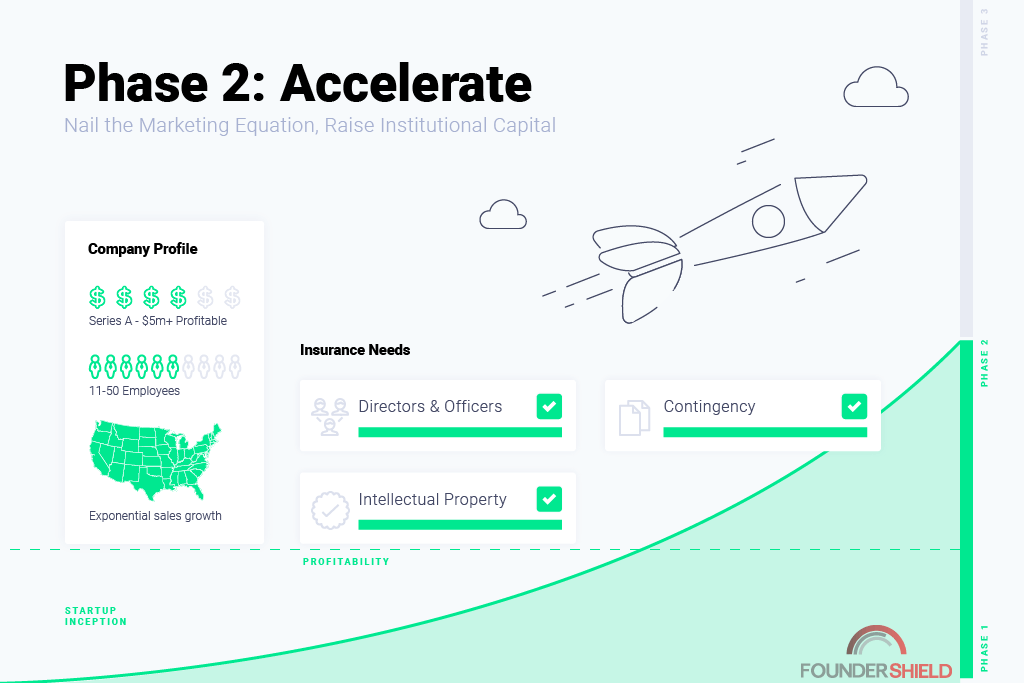

This is where things get interesting. Companies in this phase usually have:

- Raised at least a $5M+ Series round, depending on the industry and product

- Developed a solid marketing equation to drop the cost of acquisition per customer and maximize customer lifetime value.

- A decked-out office and a growing team of dozens of employees

Companies in Phase 2 can start to get creative by using insurance as a sword rather than a shield. Here’s how:

Directors Officers Insurance (D&O)

D&O insurance is a great tool for companies at the earlier end of Phase 2 and an absolute necessity for later stage companies. It’s a shield that protects the company’s directors and officers from lawsuits that personally names them for an alleged wrongdoing, such as regulatory investigations, shareholder disputes, class action lawsuits, and more.

D&O is required by almost every institutional investor term sheet. The reason is simple: they’ll be taking a board seat as part of the deal and want to make sure that they’re protected for the decisions made as a board member. If you’re raising a Series A or beyond, there’s simply no way around it.

For companies entering the initial stages of Phase 2, leveraging D&O insurance can be instrumental in securing the first institutional round of funding. While D&O coverage may seem unfamiliar to first-time founders, seasoned entrepreneurs often prioritize acquiring this protection even before embarking on their fundraising journey. They understand that presenting a polished image and demonstrating proactive measures in avoiding the risk through necessary risk mitigation, such as purchasing D&O insurance, enhances their credibility with investors.

As companies move later into Phase 2 by raising a Series B or C round, D&O becomes an absolute necessity. The cap table gets complicated, revenue scales, and the company becomes a bigger target for many stakeholders: shareholders, customers, and regulators.

One pro tip for buying D&O insurance: given how crucial it is to protect both the company officers and the venture fund’s board representative, many private placement memorandums actually allow venture funds to pay for an investment company’s D&O out of their operating fund. You can get your funding secured and get protected, all at no cost to the company.

Intellectual Property Insurance (“IP”)

Some standard insurance products, including general liability and media liability insurance, cover basic intellectual property scenarios. They’ll kick in to cover alleged copyright or trademark infringement caused by the company’s advertising activities, but don’t extend far beyond that.

Intellectual property insurance provides much greater coverage because it extends the definition of covered “intellectual property” to include patents. This is extremely important for any company whose core value is tied up in the IP that it has developed.

IP insurance can be used as a sword in a few different ways. For starters, it’s one of very few insurance products that’s considered “abatement insurance.”Abatement products will actually cover the costs of not only protecting you from patent trolls, but defending you against infringers. That’s right: you can buy IP insurance that will sue infringing parties on your behalf. There are even certain providers out there that will run a proactive patent clearance process that offers ongoing scanning of various databases for potential infringers on your IP.

Furthermore, IP insurance can also help fund the company. There’s a type of IP insurance called “collateral protection insurance” that works like this:

- The company buys IP insurance

- Once patents are cleared, the IP insurance company arranges a loan (usually $2-4M) using the IP as collateral for the loan

- The company gets funded without giving up any equity

This can be powerful tool for companies in the Biotech space that are heavily valued by their IP and often need larger early stage funding rounds to get the product viable for commercial use.

Contingency Insurance

Contingency insurance products are extremely interesting for companies that want to use insurance as a sword to gain an edge in customer acquisition.

“Prize indemnity insurance” actually allows companies to pay an insurance premium for a policy that will pay out the full amount of a prize offered by a company for a contest. Think McDonald’s monopoly game or the NCAA bracket challenge. Rather than paying out $1M to the winner of a bracket challenge contest, the company can simply buy an insurance policy for a fraction of that and the insurance will pay out the full winnings should a participant win.

A “prize redemption insurance” policy will pay out when the company runs a contest that is certain to have some winners but ends up with way too many winners. The insurance carrier will indemnify the company for the amount it has to pay over the expected winnings that would result from the contest.

Contingency insurance is anything but a cost center for a company. If anything, it’s a marketer’s dream. It can allow for rapid acquisition of customers while hedging the risk of completely draining the marketing budget.

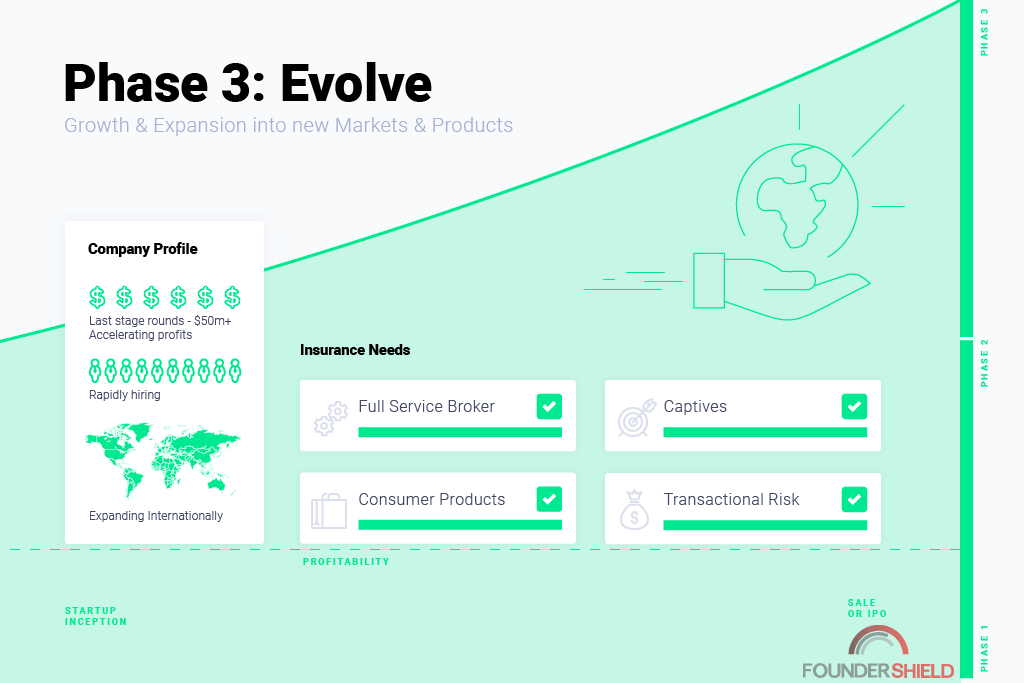

Phase 3 companies are focused on building a monster. In this phase companies are:

- Raising late stage growth rounds ($50M+) or considering an IPO

- Expanding to new continents and opening offices worldwide

- Building an acquisition strategy to offer ancillary products and conquer new markets

It goes without saying that these companies must fine-tune their existing insurance program to make sure they’re protected with these big initiatives. However, there are many ways to rework the risk management strategy to accelerate revenue generation in this phase as well.

Customer-facing Products

It’s traditionally been a challenge for sharing and gig economy companies to provide end-user insurance products. AirBnB led the charge here with their $1M renter guarantee back in 2012 but it wasn’t cheap.

It’s still not cheap to build a program like AirBnB’s, but the good news is that there are more specialty providers in the insurance marketplace that are helping companies give their users options to:

- Buy per-night rental insurance for their shared home

- Buy E&O insurance when on-boarded as a contractor

- Buy property insurance to cover rental equipment they’re listing

These are just a few examples and the market is only growing in this space. There are multiple benefits to setting up this piece of an insurance program. Customers get a better experience by feeling protected when using the company’s service, leading to cheaper customer acquisition and stronger adoption and increased brand loyalty. Furthermore, companies can sell these products to end users at a slight premium, creating another revenue stream.

Transactional Risk Insurance

Many companies in Phase 3 activate an aggressive acquisition strategy to supercharge company growth. They identify smaller competitors or complementary products to their own line and acquire rather than build in order to speed up the growth process. Insurance can accelerate this model by providing a great transactional hedge for buyers to make sure there’s no hair on the deal.

“Representations and warranties insurance” protects a company from financial losses that arise from unknown or unintentional breaches of the seller’s reps and warranties in the deal documents. Most acquisition agreements include negotiated indemnity provisions where the seller indemnifies the buyer for certain situations. This policy is designed to cover cases where the seller cannot actually indemnify the buyer due to an unknown/unintentional breach or insolvency of the seller. Placing a policy also reduces the amount of the transaction that the seller must place in escrow. This can incentivize doing the deal with the policy-holder when there other bidders requiring higher escrow holdings.

“Tax contingency insurance” covers unknown tax liabilities at the time of the transaction. Sometimes an acquisition can trigger some quirky tax liabilities on that land on the purchaser and this product can mitigate that risk. As it reduces the risk that needs to be indemnified by the deal documents, it can also affect the amount that must be held in escrow, providing a benefit to the seller and pushing the deal forward.

Insurance Process

Insurance can become quite cumbersome in Phase 3. As companies expand into new markets and territories, they’ll have to be constantly updating their insurance policies to protect these initiatives: adding locations to policies, modifying policy limits, or endorsing policies to cover new ancillary revenue streams.

It’s important to work with a broker than can handle the ever-increasing policy servicing demands. They’ll need to be constantly re-evaluating and tweaking the program. It’s essential to have an insurance broker that can access specialty products for your industry and use clear communication, tech, and efficient process to streamline your operations. Nobody wants to be held up by a last-minute insurance issue just before launching a new product line or location.

Captives

One other way for Phase 3 companies to generate revenue from insurance is by setting up a “Captive.” A captive is basically an insurance company owned by your company. Here’s how it works:

- The company creates an entity to act as the captive

- The company allocates funds to running the captive and paying for claims

- Any claims covered by the captive are paid out of these funds

- If the captive is profitable (less losses than funds paid into the captive), the company can distribute profits from the captive back to the company and its shareholders provided enough of a capital reserve is left to cover future losses.

Captives can be a great tool for later stage companies with great loss control procedures and well-defined risks. While it’s a risk/reward play given the company’s own funds are at stake for paying losses, captives can not only save the company money on premiums but can also create an additional revenue stream in the form of profits when claims don’t have to be paid out.

Tying it all together

Insurance doesn’t have to be a chore or a cost center. It’s crucial for venture-backed companies to get their basic insurance program running early but there’s much more to it than that. A carefully designed insurance program can not only hedge the downside of rapid growth, it’ll help you safely accelerate it. Work with a broker that can successfully manage a company’s development and put you on the road to hypergrowth.